Among the various approaches to investing, one approach that makes theoretical sense to me is the one where we invest in businesses where the incremental returns on invested capital in the long run are higher than (1) previous returns on invested capital and (2) the cost of acquiring that capital. Needless to say, such an investment has to be at a fair valuation.

Key point in this theory imho is “in the long run”. Many businesses have been successful at sacrificing short term profits, cash flows to build higher profits, margins and free cash flows in the longer run.

An example that comes to mind is Bata. I remember Bata as a very entry-level, mass market brand (mass market is where MRP <1000). Today, premium brands (Hush Puppies, Power, etc) contribute to Bata’s topline by more than 50%.

As seen in the image above, over a 12 year period, sales have increased by 4x approximately, but operating profits have gone up by 13x. Not only have they sold more number of shoes each year, they have also sold each pair at higher price points and margins.

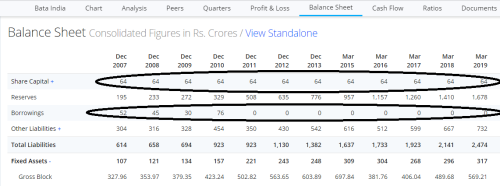

What did achieving this cost their balance sheet? Nothing except marketing/branding efforts. They didn’t have to raise equity capital to grow sales. Neither did they borrow - in fact they paid off all debts in this period.

So the Bata success story can be summarized as:

- Low-margin, high volume player in a competitive market

- Acquires customer loyalty

- Simultaneously works on selling higher value, higher margin products to these customers without stretching itself into equity dilution or debt

- Sees exponential growth in profits and free cash flow, thus creating shareholder value