Post originally written on April 13, 2020

Disclosure: This is not a buy/hold/sell recommendation. This is for information purposes only.

Innovator Drug Development: For CDMOs, the most critical driver is presence of an innovator portfolio, specially with a wide spectrum from early stage to commercial manufacturing. Syngene and Neuland are CDMOs with significant revenue share from innovator portfolios, that received investments from global and local PE funds.

I recently came across this report from IQVIA on the 4 drivers of growth areas in Pharma and it got me interested in Neuland Labs Limited. I like businesses that operate as a niche in a large segment, acquire customer loyalty and then grow sales and margins hanging on to that customer loyalty instead of competing on price. Anyway, here are some thoughts on Neuland:

What do they do?

- A high volume, low margin, highly competitive Prime API segment - major products are Ciprofloxacin, Levetiracetam, Levofloxacin, Mirtazapine Enalapril Maleate, Sotalol, Labetalol and Salbutamol.

- A Speciality API segment - currently has 25 molecules in this segment. Of these, patents for some molecules are yet to expire. In many molecules the co is either the sole or one of 2 suppliers even though few others may have filed a DMF. Important from revenue perspective Salmeterol, Dorzolamide, Paliperidone, Deferasirox, Donepezil and Brinzolamide.

- A Custom Manufacturing Solutions segment - A typical pharma research or bio-tech startup based out of Switzerland or London or Tokyo would typically focus on research and outsource scale-manufacturing to low-cost countries provided regulatory standards are met. This outsourced manufacturing service is the CMS business of Neuland. It works with innovator pharma / biotech cos, both small and large and offers both small-scale clinical trial quantities & commercial-scale. It is equipped for Preclinical to Phase III through to commercial API manufacturing. Entire revenue in CMS from US, Europe & Japan. Neuland claims to have strong chemistry skills + consistently compliant facilities.

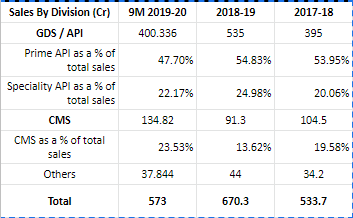

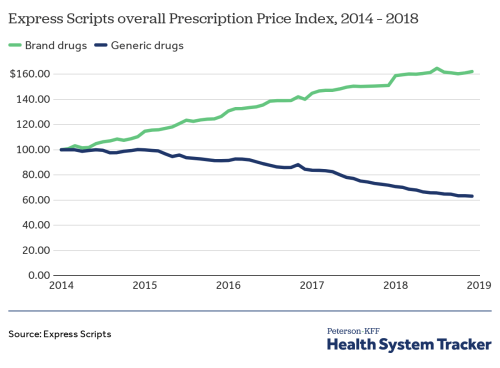

Most of Neuland’s Indian peers are generic formulation makers - many of who derive significant share of sales in regulated markets where competitive intensity is increasing and price erosion is causing margins to fall.

On the other hand, data from the Express Scripts’ Prescription Price Index suggests that average prices of branded drugs have been rising and remain unaffected by price erosion. Neuland’s CMS segment works directly with such innovator companies for clinical and commercial stage production of Intermediates & APIs for patent-protected drugs.

The CMS Business

There is a conscious attempt by the co to increase the share of Speciality and CMS businesses in the long run. ‘In the long run’ because CMS business would be volatile as it is initially heavily dependent on few companies and few molecules. Once more and more molecules get commercial approvals and client base widens, CMS can become a stable segment. Another reason is the Prime API segment itself is growing in volume terms.

In the longer run, the Speciality API and CMS business looks to be a game changer - a segment that is set to enter the flywheel mode, perhaps?

- It has much lesser competitive intensity compared to its peers because it requires strong chemistry skills and loyal customer relationships. A client who engages Neuland for pre-commercial stage production is likely to continue the commercial relationship with Neuland as well. Hence, the nuances of supplying small batches for pre-clinical stage drugs is sort of an investment in customer acquisition which will yield results over time when these drugs get commercial approvals.

- After the Chinese shut down of polluting industries in 2017-2019 and the 2020 Coronavirus crisis, pharma & biotech research companies looking to de-risk their supply chain from China would look for alternative contract manufacturers in India. One of the criteria in supplier selection would be the depth of the capabilities. Does the supplier import key intermediates from China or does he produce it himself? How many APIs can he make in-house? Neuland’s 30-year expertise in API making and its acquisition of Unit 3 will strengthen its in-house intermediates capabilities.

- As Neuland acquires deeper chemistry skills, its competitive advantage in this field can further increase opportunities. We can substantiate from this con call excerpt:

Neuland being a pure play API company, we tend to give a lot of focus and priority to our CMS business. And unlike many Chinese companies which have many aspects of their business, they do custom synthesis, they do biology, they do BMTK, they do toxicology and lot of other activities. So the attention or the focus on the custom synthesis projects may not be as high. I think the third factor is at Neuland, we also tend to be very selective on the kind of projects we work on. They are specific areas in chemistry that we believe we are very strong in…. So that kind of selectivity and the inherent skills and the business model of the company helps us to differentiate ourselves from many of the Chinese competitors.

Unlike generic API manufacturing, the CMS business requires pro-activeness, foresight and constant R&D - some points to support Neuland:

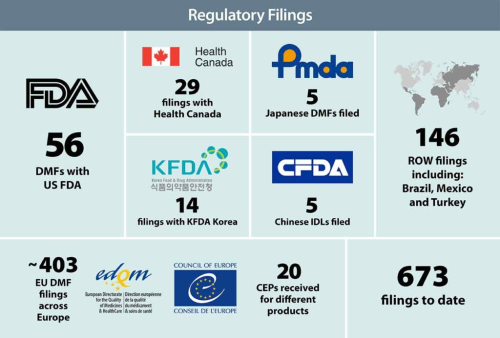

- Total worldwide DMF count of 673

- Management has guided filing of 8-10 DMFs/CEPs every year

- Neuland is the first generic player to have a granted process patent for the preparation of Sugammadex Sodium in India. Sugammadex is used to reverse anesthesia. It has also filed a DMF and wants to be an early developer even though commercial launch will be post patent expiry around 2026 for US and Europe.

- In FY 19, filed 20 patent applications of which 19 were in India and one in the US. In the same year, it secured seven granted patents (5 API process patents and 2 peptide technology related patents) in various geographies (Canada, India, Japan & Australia).

- Neuland claims to be a leader in peptide technologies and capabilities. It predicts that in 15 years as many as 50% of all drugs could be peptide-based. 9/63 of the CMS projects of Neuland are peptide projects, though there are 0 commercial sales currently. In 2018, the company entered into a partnership with Jitsubo Co, owner of two key peptide technologies: Molecular Hiving™ for production of high quality and cost-competitive peptide APIs, and Peptune™ for novel peptide modification in drug discovery stages. The management also sees potential in Peptide based APIs for the generic API market and has invested in relevant capacities. Quoting from the Q2FY20 con call:

“We have been initially doing only like peptide building blocks and maybe low value items within peptide. But over the last 5-6 years, we slowly moved forward into peptide APIs and we have been working with a lot of innovators in the CMS space on peptide projects. And now what we have been trying to do in the last year or so is to actually develop peptide even for the generic markets and we are very excited with the market opportunity that generic peptides offer……….What excite us about peptides in the generic GDS space is that the market is not very crowded and there could be certain value addition Neuland could have because of our technology where we would be able to offer peptide API at comparable quality but at a lower cost. So that is the idea. We do not expect any immediate commercial opportunities on it, but some of the peptides that we are working on, the patents are also close to expiring. So if we are successful, then in a matter of 2 to 3 years, we could have some successful products in the market on peptides. “

Management and Directors

- The Chairman & MD, Davuluri Rama Mohan Rao holds a Post Graduate Diploma in Technology from IIT Kharagpur and a PhD in Organic Chemistry from the University of Notre Dame, U.S.A. He’s a member of the Royal Society of Chemistry.

- The Vice-Chairman and CEO, Davuluri Sucheth Rao and the Joint Managing Director, Davuluri Saharsh Rao are MBA graduates from the US.

- Non-Executive Director - Christopher M. Cimarusti - holds a PhD in Organic Chemistry from Purdue University, U.S.A. and his Postdoctoral Research from Columbia University, U.S.A. More than 40 years of experience in the field of drug discovery, development and manufacturing, been awarded more than 60 patents and published more than 40 papers in referred journals. Held executive leadership positions at Squibb Corporation and Bristol-Myers Squibb (BMS) in discovery and development. His last position with BMS was as Sr. Vice President, Pharmaceutical Development Centre of Excellence.

Independent Directors

- Humayun Dhanrajgir - 45 years in the pharmaceutical industry. On the board of Cadila Healthcare Ltd., Zydus Wellness Ltd, Emcure Pharmaceuticals Ltd. (Chairman), Next Gen Publishing Co. Ltd. (Chairman).

- Parampally Vasudeva Maiya - Ex General Manager of SBI, first MD of ICICI Bank and CDSL, Previously held directorships at Canara Bank and Indian Bank.

- William Gordon Mitchell - Academician with contributions in the field of corporate strategy, emerging market strategy, and strategy in the global health care sector.

- Bharati Rao - Also on the boards of SBICAP Securities Limited, SBI Capital Markets Limited, Cholamandalam Investment and Finance Company Limited, SBI Global Factors limited, Carborandum Universal Limited, Can Fin Holmes Limited, Tata Teleservices Limited and Delphi-TVS Diesel Systems. Advisor to Brickworks Ratings Company.

- Nirmala Murthy - Founder member of the Foundation for Research in Health System.

- Homi Rustam Khusrokhan - Ex President of the Organisation of Pharmaceutical Producers of India. Currently on the boards of Strides Pharma Science Limited, Samson Maritime and Novalead Pharma Private Limited.

A well known investor from Chennai known for his forensic eye once said that a good quality check for any listed Indian company is to see how many ‘Independent Directors’ don’t share the same surname as the promoters.

Where could it go wrong?

This is where we need to really dig deeper. None of the above information means the stock is investment worthy or not especially since I do not have a background in pharmaceuticals and most of my understanding here is basic. If you have a view point on the risks in Neuland’s business, would be greatful if you could share your opinion on the Neuland Labs Ltd thread on ValuePickr.

- The numbers - The company seems to witness growth opportunities across 3 segments. They have guided volume growth along with margin expansion (co. aims at 18-20% ebitda in 3-4 years from 10-12% currently). Major capex is behind but 60-70 cr/year of product specific capex and maintenance capex would continue.Will this dilute asset turnovers? Debt levels at 200-220 crores are sort of worrying given their scale and margin profile. Key would be to monitor the next few years of debt addition + capex + R&D expenditure. Once that stabilises and growth continues, operating leverage can be expected.

- In the CMS division, the company is subject to not just USFDA checks but also customer audits. Also, given that unit 3 will be subject to its first USFDA audit in the coming quarters, compliance risk looms.